If you have extra cash on hand, one of the easiest ways to generate passive income is investing your money. There are many investment options to choose from, but one of the preferred options is investing in stocks. Depending on your risk tolerance level, you may invest in low-risk dividend-paying stocks, value stocks, or even invest in high-growth high-risk stocks. Inflation averaged over 3.05% yearly since 1926, and keeping your money in a Bank savings account would have earned you less than the inflation. Stocks have returned an average of 11.35% per year during the same period, while bonds returned 5.12%, and T-bill averaged 3.79%. There are risks associated with stock investment, so you must do your homework before deciding on your investment strategy.

Disclaimer: I am not a fund manager or financial adviser, and I do not have expertise in stock investments. The information contained in this website is a collection of stock tips and trading strategies captured from investment journals and stock investment experts. My stock investment strategy is based more on the technical trend of market and individual stocks, than fundamental analysis of individual stocks. If you choose to follow these rules and tips, it is your choice and at your own risk.

Stock Tips

- Don't buy into new highs on weak volume - Investors should watch out for stocks that are wedging higher on weak volume, which suggests that demand isn't quite there to sustain its gain. Hitting new high on weak volume creates a divergence especially if low volume continues for more than a few days.

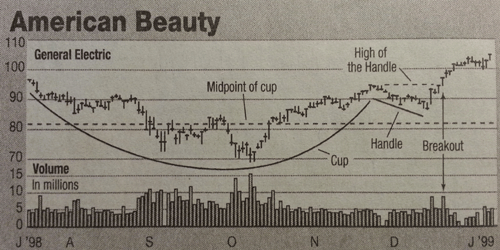

- Use moving averages to find entry and exit points - Moving average is an indicators used to determine the health of a stock. Sell when the 50-day moving average crosses under the 200-day moving average, and buy when the 50-day moving average crosses over the 200-day average. The percentage of stocks above their 50-day moving average helps determine a bullish or bearish market. Even great stocks undergo periodic corrections, and grabbing a few shared quality stocks during the handle phase is a good choice.

- Look for Cup-with-Handle Pattern - The cup-with-handle pattern often precedes huge advances among high-quality stocks. The handle should form in the upper half of the cup, and the volume should dry up as selling pressure abates. Buy when the stock rises 1/8th of a point above the high of the handle on a strong volume preferably 50% or more above average daily trading volume.

- Dollar-Cost Averaging eases downside risk in a volatile market - Dollar-cost averaging is a recommended investment strategy for buying into company stocks. Lower risk generally means lower returns, but this is the strategy you can use to set aside a preset amount of money during each pay period.

- Q: How is the Dow Jones industrial average calculated? A: The Dow is essentially the average price of its 30 component stocks if they had never been split, issued dividends, or undergone major changes such as spin-offs or mergers during the time they were listed in the index. To get from current stock price levels to the larger index number, a number called the "divisor" is used. To calculate the DJIA, the current prices of the 30 stocks that make up the index are added and then divided by the Dow divisor, which is constantly modified.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment